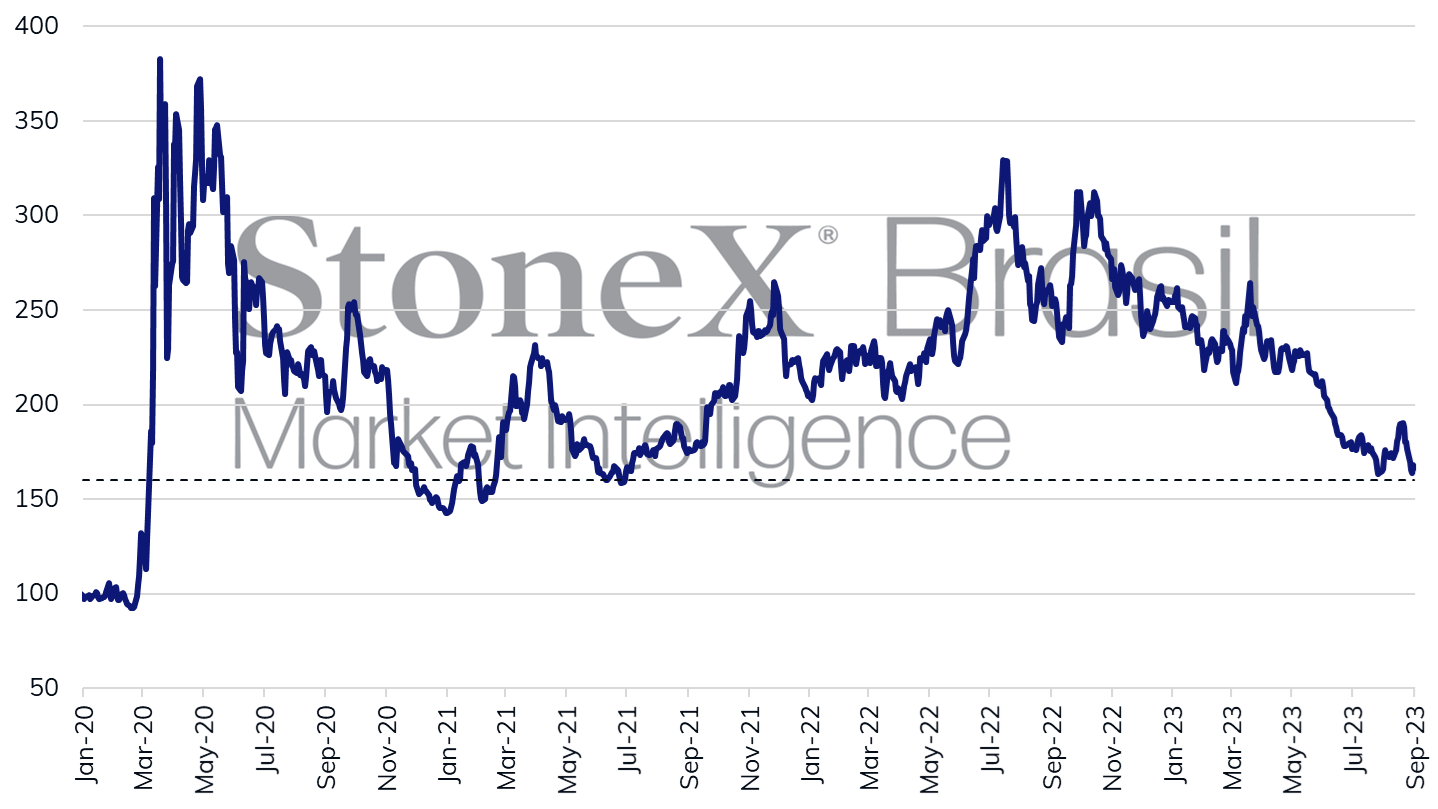

- Perception of worsening fiscal risks of Brazilian assets may raise investors' requirement of risk premiums and decrease foreign investments in Brazil, weakening the real.

- Economic data in China and Europe are expected to suggest a slowdown in these economies and could dampen foreign investors' risk appetite, weakening the real.

- Data for the US economy should suggest that economic growth remains stable, diminishing interpretations that further rate hikes will be needed and contributing to weakening the dollar.

The week in review

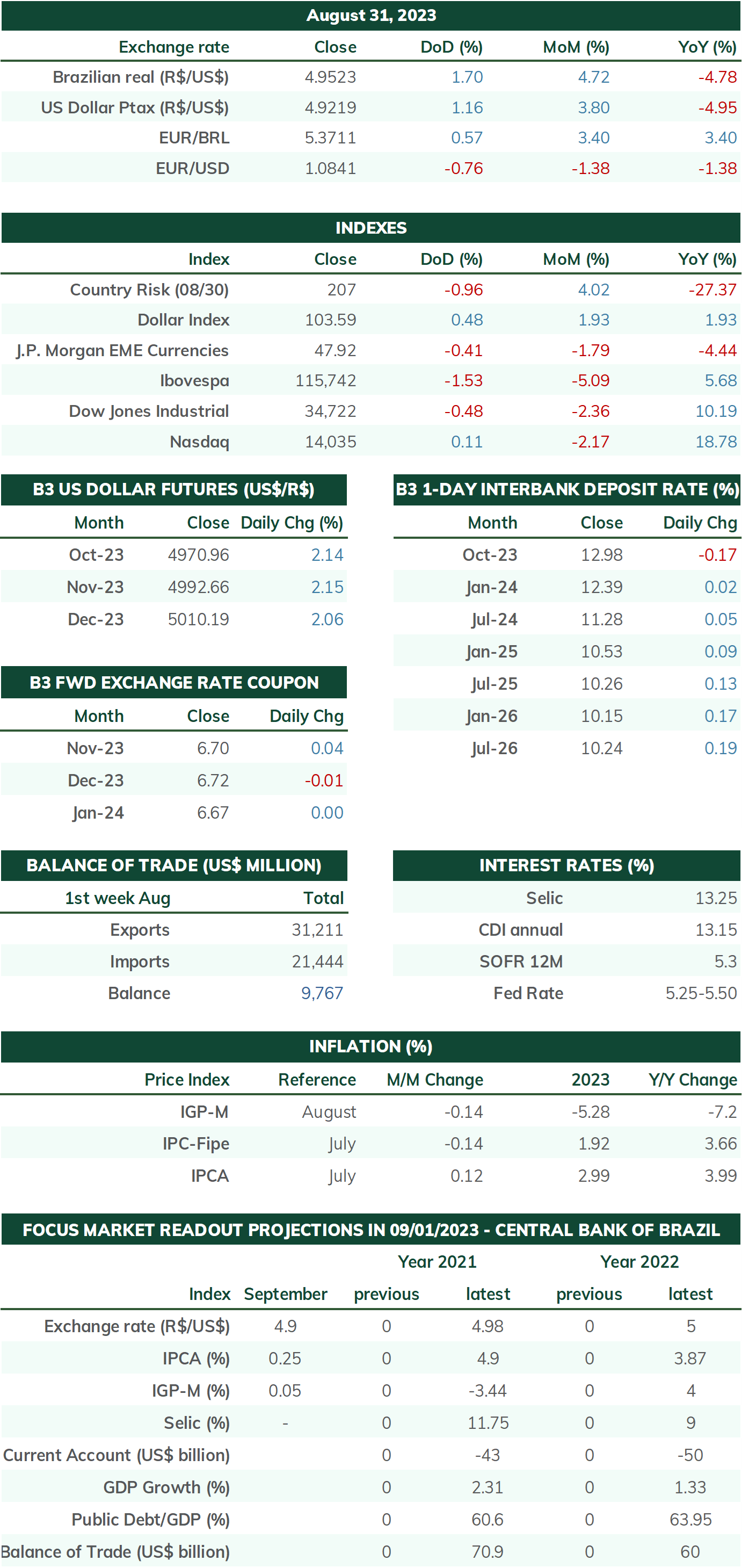

The USDBRL ended the week sharply higher, ending Friday's session (01) at BRL 4.941, a change of +1.3% in the week, +4.5% in the month and -6.4% in the year. The dollar index closed Friday's session higher for the seventh consecutive week, quoted at 104.2 points, a weekly gain of 0.2%, a monthly gain of 2.6% and an annual gain of 0.9%. The foreign exchange market reflected the perception of fiscal worsening in Brazil, the disclosure of GDP in Brazil and the US and the perception of a "soft landing" in the American economy.

Expected impact on USDBRL: bullish

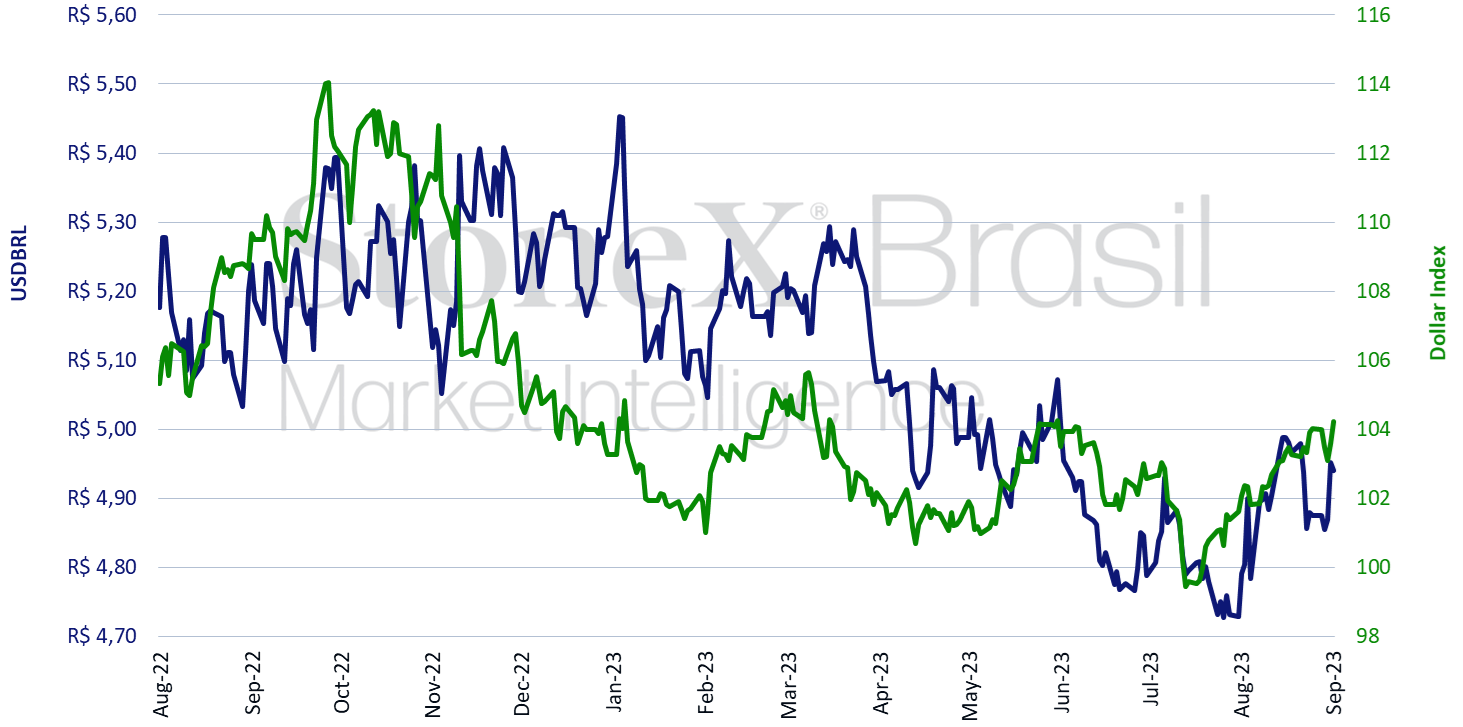

The performance of Brazilian assets this week was hurt by the worsening perception of fiscal risks amid several noises about the fiscal policy management by the Luiz Inácio Lula da Silva government. This worsening can be observed in the rapid increase in the cost of issuing Brazilian government bonds, such as the long-term NTN-B. However, another important measure of risk, the Credit Default Swap, remained unchanged in this period.

First, after much difficulty in getting the new fiscal framework approved by the Legislature, Brazil's President sanctioned the law with vetoes, including the passage that prohibited the Budget Guidelines Law from providing for the exclusion of primary expenditures from the primary result target of the fiscal and social security budgets. In practice, the veto opens space for expenses not to be accounted for within the spending limit, facilitating the achievement of spending targets without effectively reducing public spending to the same extent.

In addition, the Administration sent the Federal Congress the Annual Budget Bill (PLOA) of 2024 with the primary budget deficit target of 0.0% of GDP, as determined by the fiscal framework law, but with a forecast of BRL 168 billion in new revenues. Most of the measures that would result in this extra amount still need legislative approval, such as the return of the tie-breaking vote in the Administrative Council of Tax Appeals (Carf), the approval of the Provisional Measure that changes the system of exemption from investment subsidies, the proposal to end Interest on Own Capital and the proposals for taxes on exclusive and offshore investment funds. In practice, this makes it difficult, not to say unlikely, that the federal government will be able to meet its primary outcome deficit target given the number of variables that could not occur differently than planned.

Finally, the economic team's own discourse, which focuses almost exclusively on the form of revenue increase and ignores alternatives to reduce costs and expenses, also contributed to the increase in the concerns of financial agents about non-compliance with fiscal targets.

Expected impact on USDBRL: bearish

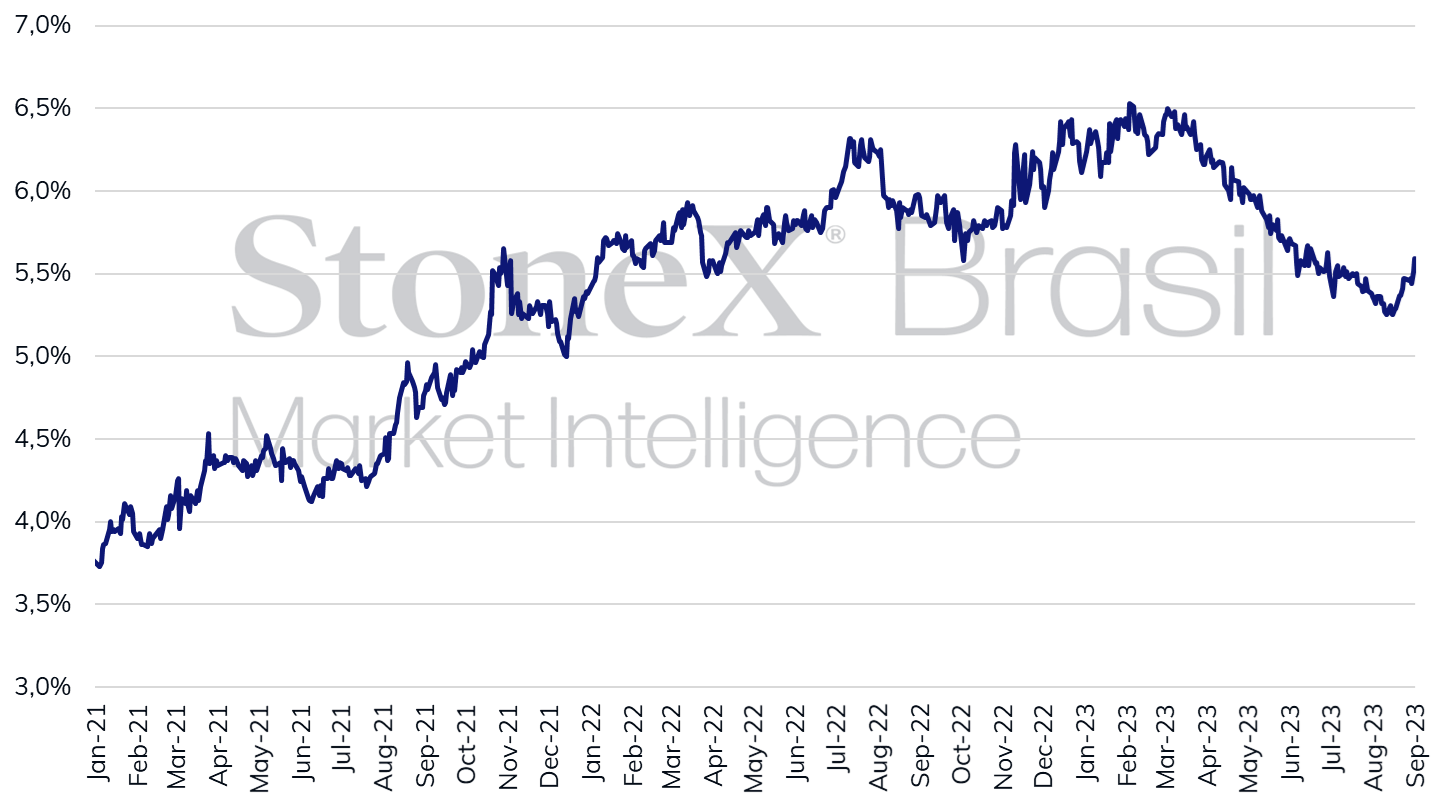

Week emptied of indicators, with a national holiday on Monday. Attention will be turned to releasing the Purchasing Managers' Index (PMI) of services for August, released by the ISM on Wednesday. The services sector has been the focus of analysts, accounting for approximately 70 percent of the US gross domestic product and having sustained growth in recent months. Last week, the manufacturing PMI held on to contraction (reading below 50 points) for the tenth consecutive month but recorded a higher-than-anticipated value, rising from 46.4 points in July to 47.6 points in August. In addition, the price and employment subcomponents also performed better than projected. Next week, the services PMI is expected to remain in expansionary territory and record a reading close to July's figure of 52.7 points, reflecting the progress of most regional sectoral indices.

Expected impact on USDBRL: bullish

This week, the services PMI and the consolidated PMI for China and the eurozone will be released, with a mild slowdown expected for both economies. The indexes should mark readings above 50 points for China, revealing that the country continues to grow slower. The European continent, on the other hand, is expected to score readings below 50 points – that is, an absolute retraction – in both the consolidated index and the services index, reinforcing an interpretation that the unified currency bloc is very close to an economic recession in an unfavorable macroeconomic environment of rising interest rates and inflation still much higher than the target.